General

Banco Santander was not the only banks to publish their results and we can start to draw some more general conclusion on the european banking sector:

The 'normalisation’ of the interest rate are acting as a positive wave for the whole sector - maybe the only exception would be banks in countries that have predominantly fixed rate on mortgage (cc France)

The sector is again starting to (slowly) invest, the restriction post Basel rules seems to ease as those companies have the financial cushion. This could be accelerated in the future and bring even more organic growth to the sector - and hopefully help the gdp grows.

Young / Small Fintech have been affected by the VC winter, well established (wise, Nu Holding, N26, Revolut, Monzo, …) do seem to do very well but so far it looks like big banks seem to do relatively fine compare to those new incumbents.

Consolidation is still ongoing after Credit Suisse absorption, Ageas having a (big) participation being taken, Sabadell being in discussion for takeover, … It looks like size do matter more than ever with small player having some difficulties to leverage all the regulation decently.

High interest rate start to impact consumption, even on the ecommerce - adyen results were not as good as expected showing some deceleration (not even mentioning nexi nor worldline)

Alternative payment method are increasing their take (cash app in the US, Twint in Switzerland, Bancontact in Belgium, MB way in Portugal …), for now credit card giant seems to not feel it thanks to the move from cash but this could end in the future as young generation are not as reliant on them and local banks tend to have (part) ownership in them.

The valuation of the European banks are still showing very low multiple, almost all of them are sub 10 for the PER, even after the increase last year (lots are at 7 and few at 5).

The risk is, for now at least, not showing any sign of going up.

…

Banco Santander

Let’s start to dive into the specific with Banco Santander, the Spanish giant that operates on lots of geographies and 3 continents (Europe and North/South America). This makes it a good benchmark to see how different geographies are doing.

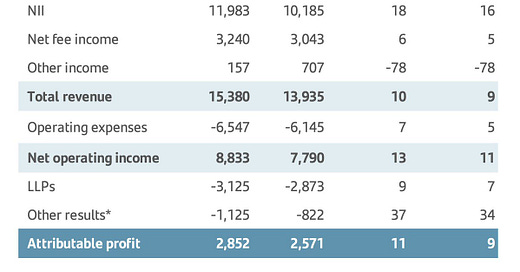

The numbers are as you can see below quite healthy, growing at around 10% the top and bottom line, if we would use the PEG, Santander would be at almost 0.6 …

In addition, the RoTE is at 14.9% (16.2% without the one off), very healthy numbers.

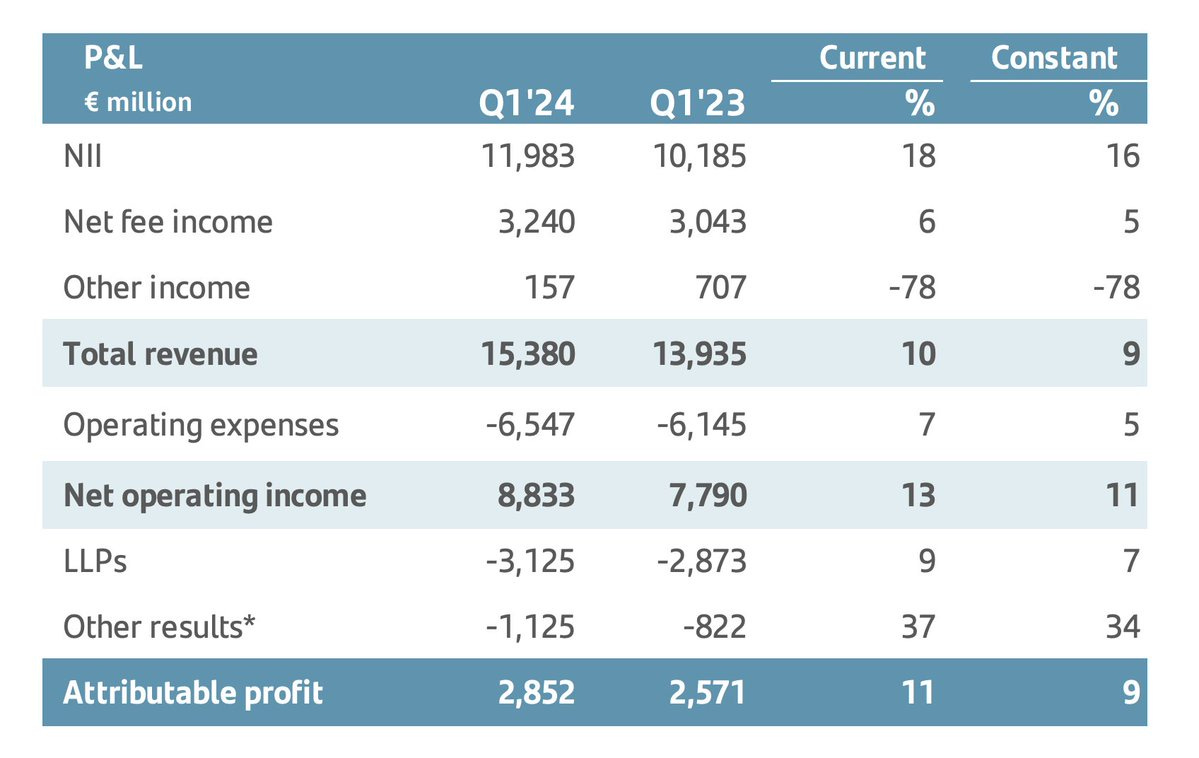

If we dive into the different divisions, the numbers are as follow:

The branch showing the lowest number - Payments - is actually for me the most interessant branch they have and the one that, if done properly, could bring a lot of leverage to the bank. And if we go into the details of this branch, the atone growth can be easily explained by a one-off, and we can see double digit growth (with a number of transaction increasing by 21%) that is almost 2nd best in class behind the leading - adyen.

PagoNxt seems to have a lot of potential, I would suspect a spin-off in the next couple of years as soon as it validates its potential to provide additional value to the shareholders - or Santander sees a huge re-rating but it is doubtful a bank would get the valuation ratio as a Fintech.

Fun Facts

The market with the highest RoTE are Portugal, Peru, Uruguay and Spain and lowest are US and UK. I would suspect Santander is staying there more to have access to capital market there, I would hope for a reduction there to focus on its higher potential Latin America market (+ south europe)

Situation in Argentina seems to get a bit better with a Operating profits back. Let's see if Millei impact will show positive or negative in the next quarters

Latin America seems to be doing well - very strong numbers in Mexico, Brazil and Chile with good trend for Uruguay and Peru (but from a smaller start)

Loan activity is not that strong but the Mutual fund is => less risky business up.

Summary

Santander is keeping its cash cow reputation, my investment thesis of a decent growth (close to double-digits) with shareholder driven returns (buyback and dividend), makes it very attractive as a defensive position in the portfolio with its (forward PE of 6.5 and dividend yield of 4%+ with a big buyback).

Presentation link is https://www.santander.com/content/dam/santander-com/en/documentos/resultados-trimestrales/2024/1q/rt-q1-2024-banco-santander-earnings-presentation-en.pdf