First and foremost, I would like to thank all the people that followed me or liked my previous post, I wasn’t expected anything of this scale (we are just talking about a bit more than 10 subscribers and few likes, but for me it represents a lot and comes as a (huge) surprise). I almost had the feeling of being a rockstar …

As the Q1 is coming to an end, I need to do a small recap of the performance and to be transparent, I will compare against my previous substack to have all the performance on the public record and try to be as honest as possible.

The numbers

Let’s start with the numbers, the quarter didn’t started so well but it finished well (almost as if the opening of the substack change the trend :p). However, I have to recognise that the main summary of the Q1 I can give was the change of investing philosophy into a more diverse portfolio with less concentration. I know, great investors will say that if you want to overperform the market, you need concentration BUT I think I am not yet ready or at least it doesn’t seem to suit me well.

My main account (DeGiro) finished the quarter at 39.015,19€ vs 37.619,07€, a 3.68% increase.

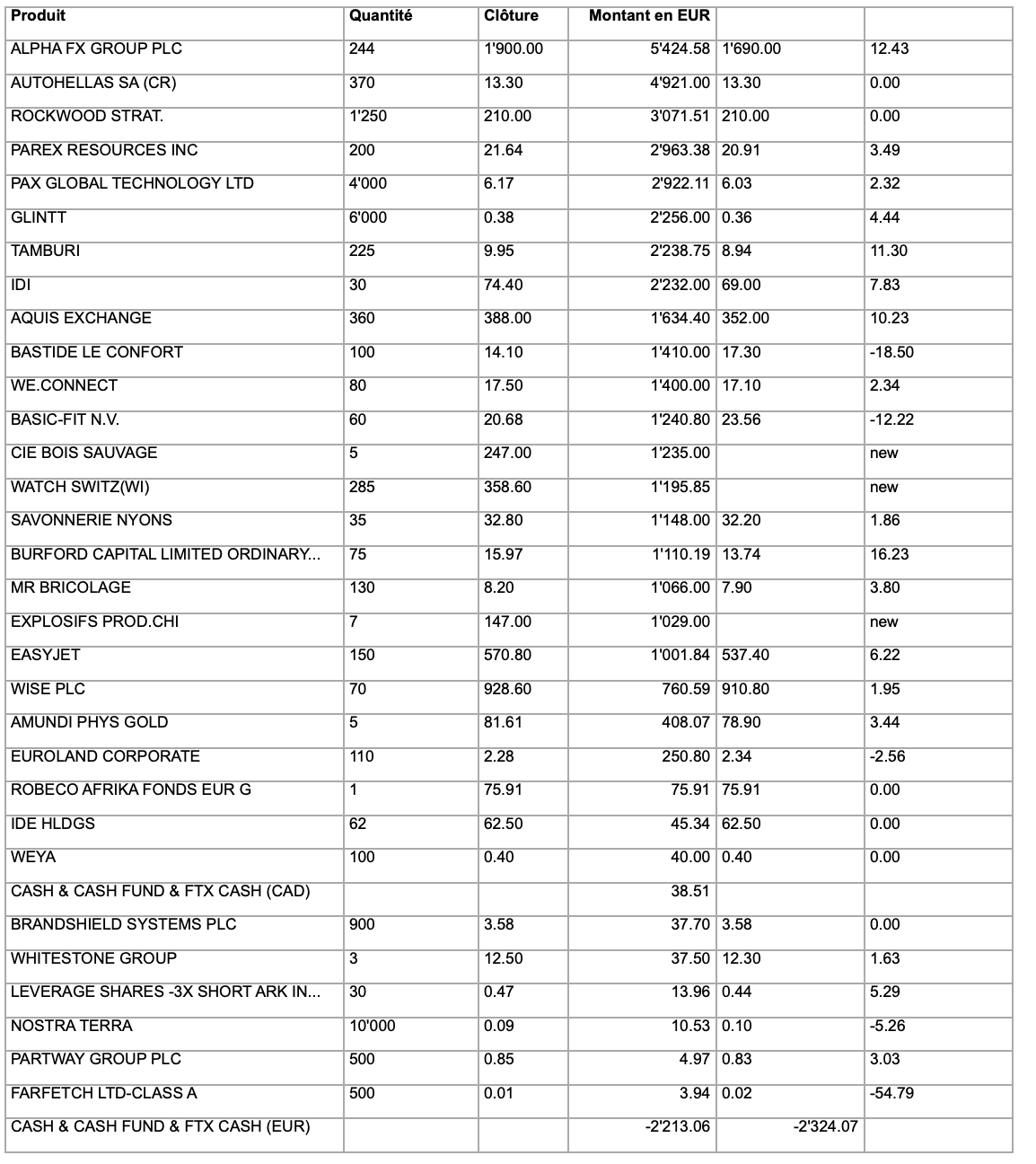

Please find below the position:

The Interactive Brokers stands at 9,165.07CHF (or 9 .413,14€) vs 8.128€ with a 1.000CHF deposit which translate with an increase of 3.17% and stands at 9 410,23€.

This means that the sum stands at 48,425.42€.

New position(s):

As you can notice, there are 3 opened positions:

Compagnie du Bois Sauvage $comb.br at 247€ per share, it is an holding mainly focus on (luxury) chocolate making from Belgium with some real estate and other investment activities. In short, the investment thesis is:

Dark headlines on Cocoa price crushed the share price leading to a low ratio if you compare to a couple of years ago’s profits

2023 results were reasonable (even though impacted by the bad year in real estate)

The chocolate business is resilient with (very) strong brands

Real Estate and other investments are not even necessary for a potential re-rate

I love chocolate, and as part belgian, I need to support the local business :)

The share repurchase program is highly accretive (better this that more and more real estate investment) and dividend yield is interesting

Watch of Switzerland $wosg.l at 332,2p a share, a retailing company specialized in luxury watches in Europe, UK and US. The idea came from @ParthenosCap, thanks to him for putting the company on my radar. In short, the investment thesis is:

Moaty and boring business due to the inherent business (you cannot open rolex stores as you wish, you need a licence) and the luxury watch business is growing at a slow pace for years (the covid huge increase is an outlier)

Share price crashed due to the purchase from Rolex of one retailer spreading the threat that rolex would try to internalise the retail part of the business (and the come back to a more normal trend).

I think this threat is made bigger than it really is, I do not see Rolex trying to do the full retail in house, it would be very risky also for them - you cannot replicate a luxury retail business easily, location are not that easy to get and it takes years to build the network. In my opinion, Rolex needs wosg almost as much as the other way around - and who wants to have to deal with a sales army when somebody did it for you for years with good results. (Or you buy them)

EPC group $EXPL.PA at 146€ per share, a company specialised in explosifs. In short, the investment thesis is:

Moaty business, you need license and know-how to deploy such products

International footprint that helps to balance the strength of industry and markets

Management successfully did a turnaround and the perspectives are (very) good

All this for around PE of 10 with little debt and a dividend

Updated Position

INDEPENDANCE ET EXPANSION EUROPE SMALL - I added 1.032 € to this fund.

Pax Global Technology - decreased by about half the position, to echo my last substack, I wish to reduce the concentration in the portfolio, it stays a strong conviction overall.

Thank you for reading, I might do some deep dive on the less known shares (if you would have any preferences, feel free to propose) as it could be something fun to do.

Welcome to substack soon you will get hundreds, what is your valuation of Bois sauvage?